- Joined

- Apr 8, 2014

- Messages

- 3,967

- Reaction score

- 4,124

- Points

- 113

....and the world has not ended so far.

http://www.cbsnews.com/news/fed-hikes-interest-rates-for-first-time-in-a-decade/

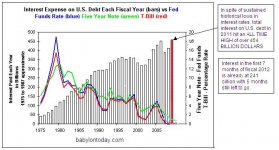

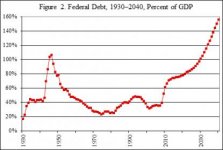

From a financial standpoint, this is an historic moment for the country and the world, especially in the context of what has been going on since the Fed set rates at those levels seven years ago.

We'll have to wait and see what the repercussions are, as they continue to elevate borrowing costs over the next couple years, but they have made the first step without the markets collapsing.

http://www.cbsnews.com/news/fed-hikes-interest-rates-for-first-time-in-a-decade/

From a financial standpoint, this is an historic moment for the country and the world, especially in the context of what has been going on since the Fed set rates at those levels seven years ago.

We'll have to wait and see what the repercussions are, as they continue to elevate borrowing costs over the next couple years, but they have made the first step without the markets collapsing.