Yes .... the person that earned it was taxed on it. You could say the same thing about any employer that has an employee that he gives a paycheck to every week. The employer earned the money through the operation of his or her business and is now going to give some of that earned money to the employee. Income is income.... why should it not be taxed just because it came from a family member.

As you have already been schooled, an employer's payment of wages to an employee is not taxed, other than the expenses related to workers comp, withholding matching, etc. It is a business expense.

And as to your frankly dumb comment about "paying the gardener" vs. willing the money to a relative, the explanation is as basic as breathing. Spending - use - of the money by an employee does not generate further income taxes on the employee; the economic activity generates a tax obligation on the part of the

recipient of the spending. Why? Because that individual is pursuing gainful economic activity and making money, so he needs to contribute to everything that allows him to make that living - roads, courts, police, etc.

If I earn money and save it, with the goal of giving the money to my heirs, I am not pursuing economic activity from the money. I am saving it. However, guess what, sport? The investing generates capital gains, which results in A SECOND ROUND OF TAXES ON THE INCOME.

So then I give my money to my kids. No capital gains. The money is now either saved by my heirs (capital gains) or spent (sales taxes, further taxes on the merchants who earned the business).

The idea that a 3rd or 4th or 5th round of taxes is needed is just sick. Really, it's sick. How much ******* money does the ******* government deserve?

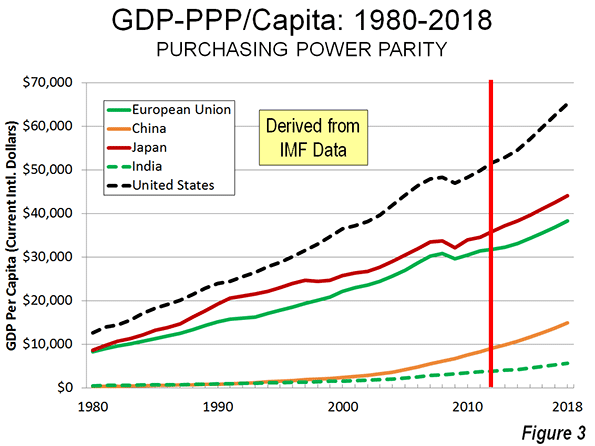

Finally, do you know why the United States dominated economically in the 1980's? And did well in the 1990's? Because our tax rates were much more protective of the income-earners than the tax rates for most of our capitalist competitors. The United States posted better GDP growth, despite our massive starting point, than EU and Asian nations: