Jee-zus. Bammy's first two budgets had deficits of $1.3 trillion and $1.3 trillion. He bravely oversaw deficit reductions down to $1.1 trillion, $680 billion, $485 billion, $438 billion, then back up to $585 billion and $665 billion. (Trump not responsible for the 2017 budget, right, 21??)

So your hero oversaw a total of $6.5 trillion - TRILLION - added to the national debt over a span of 8 years, or an average - AN AVERAGE, 21 - of more than $800 billion per year.

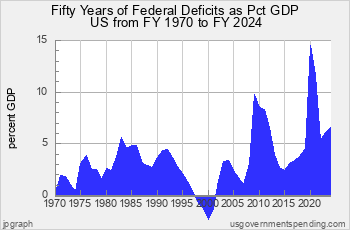

https://www.usgovernmentspending.com/federal_deficit_chart.html

The deficit and burgeoning national debt are very serious problems - that apparently only now matter, after the $6.5 trillion goat-**** that was the Bammy economy. But in terms of where the deficit is in terms of our economy, the current deficit runs about the same as a percentage of GDP as it did during the 1980's and a significant portion of the Clinton years.

Bizarrely, you blame Republican Presidents for the deficit, apparently forgetting that the Constitution specifically delegates the power to tax-and-spend to Congress.

Article 1, Section 8, Clause 1: "The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States."

Do you notice that the deficits explode when (D)ims hold Congress? 1975-1977, 1983-1989, 2007-2011. And when the budget was closer to balanced, the (R)'s controlled Congress - 1995-2001, for example? Did you notice that?

Yeah, thought so.