- Joined

- Apr 9, 2014

- Messages

- 414

- Reaction score

- 210

- Points

- 43

So we have an arguably astute business man as President now. Can he curtail the national debt? Let's start having real conversations here. This **** slinging and dick grabbing isn't very productive.

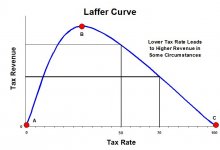

Let's put aside partisan tactics for this and be reasonable and rational. I usually tune out anytime someone starts in on the "libby" or "conservaterror" or whatever bullshit. There's pros and cons to both ideologies. I certainly have my views from a social standpoint. But outside of that we need both for balance. Each are wholly capable of corrupt and shameful tactics. Have any of you actually taken a long hard look at the deficit. What's really in there? Conservatives always point to entitlement programs and the lack of adjusted or realative tax revenue for profiteering and market spending (or more bluntly a lack of tax breaks for individuals they think can spend money more wisely than the govt) as a deficit culprit and liberals are always focus on regulatory practices, closing loopholes, and tax parity. The thing that the politicians never make clear is that the government debt i.e. the budgeted spending and taxation will continue to fluctuate and can be corrected through a disciplined combination of BOTH of these ideals. HOWEVER......the debt owed by the govt budget is only 30% or so of the deficit. The other 70% is public debt. Foreign debt alone is massive. By itself it is probably more than the debt from the govt budget. That is not something that can be fixed easily AT ALL. Then there's what the Federal Reserve owes that has been borrowed, banking/market debt, insurance debt, and then the debt on bonds which is like duct tape at this point.

Here is a breakdown of the US debt held by foreign nations:

http://ticdata.treasury.gov/Publish/mfh.txt

So what can be done here?

Let's put aside partisan tactics for this and be reasonable and rational. I usually tune out anytime someone starts in on the "libby" or "conservaterror" or whatever bullshit. There's pros and cons to both ideologies. I certainly have my views from a social standpoint. But outside of that we need both for balance. Each are wholly capable of corrupt and shameful tactics. Have any of you actually taken a long hard look at the deficit. What's really in there? Conservatives always point to entitlement programs and the lack of adjusted or realative tax revenue for profiteering and market spending (or more bluntly a lack of tax breaks for individuals they think can spend money more wisely than the govt) as a deficit culprit and liberals are always focus on regulatory practices, closing loopholes, and tax parity. The thing that the politicians never make clear is that the government debt i.e. the budgeted spending and taxation will continue to fluctuate and can be corrected through a disciplined combination of BOTH of these ideals. HOWEVER......the debt owed by the govt budget is only 30% or so of the deficit. The other 70% is public debt. Foreign debt alone is massive. By itself it is probably more than the debt from the govt budget. That is not something that can be fixed easily AT ALL. Then there's what the Federal Reserve owes that has been borrowed, banking/market debt, insurance debt, and then the debt on bonds which is like duct tape at this point.

Here is a breakdown of the US debt held by foreign nations:

http://ticdata.treasury.gov/Publish/mfh.txt

So what can be done here?