You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump - Make America Great Again!

- Thread starter IndySteel

- Start date

- Status

- Not open for further replies.

- Joined

- Apr 8, 2014

- Messages

- 13,807

- Reaction score

- 6,387

- Points

- 113

Not gonna hold my breath.The simple fact is that Trump would release his PERSONAL tax records...

The truth is out there, somewhere....

Newsweek: Trump's financial conflicts of interest 'A National Security Nightmare'

http://boingboing.net/2016/09/13/trump-newsweek-eichenwald.html

<blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">My big cover story in <a href="https://twitter.com/Newsweek">@Newsweek</a> that could change the dialogue about this election season will be published online tomorrow.</p>— Kurt Eichenwald (@kurteichenwald) <a href="https://twitter.com/kurteichenwald/status/775791710995644417">September 13, 2016</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

<blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">.<a href="https://twitter.com/MSNBC">@MSNBC</a>/<a href="https://twitter.com/maddow">@Maddow</a> obtains Newsweek story set to publish tomorrow on Trump biz ties: "web of contractual entanglements" <a href="https://t.co/6ruY6kS42Q">pic.twitter.com/6ruY6kS42Q</a></p>— Steve Kopack (@SteveKopack) <a href="https://twitter.com/SteveKopack/status/775873415924293632">September 14, 2016</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

Journalists Full of Questions as Eichenwald Tweets That He Has a Big Trump Reveal for Tomorrow

http://www.mediaite.com/online/jour...-that-he-has-a-big-trump-reveal-for-tomorrow/

And right on cue, the basket of deplorables show up to attack the journalist...

<blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">Man, it feels like I'm shoveling manure out of the barn blocking all the anti-semites and racists who have suddenly appeared on this feed.</p>— Kurt Eichenwald (@kurteichenwald) <a href="https://twitter.com/kurteichenwald/status/775849665115877380">September 14, 2016</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

<blockquote class="twitter-tweet" data-lang="en"><p lang="en" dir="ltr">The basket of deplorables emailing me. Ive been called kike, jew boy, etc. Not that it matters, you Trump anti-semites, but I'm episcopal.</p>— Kurt Eichenwald (@kurteichenwald) <a href="https://twitter.com/kurteichenwald/status/775838673497653248">September 13, 2016</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

- Joined

- Apr 8, 2014

- Messages

- 13,807

- Reaction score

- 6,387

- Points

- 113

The basket of deplorables strike again...

Deplorable? 69-year-old woman punched in face by Trump supporter outside NC rally

http://wlos.com/news/local/69-year-old-woman-punched-in-face-outside-rally-by-trump-supporter

Deplorable? 69-year-old woman punched in face by Trump supporter outside NC rally

http://wlos.com/news/local/69-year-old-woman-punched-in-face-outside-rally-by-trump-supporter

ASHEVILLE, N.C. (WLOS) - Police say they arrested five people at Donald Trump's rally Monday night in Asheville, and as of publishing have warrants out for two more people.

Police plan to arrest Richard Campbell of Edisto Island, South Carolina for assault on a female. That female is 69-year-old Shirley Teter.

- Joined

- Apr 12, 2014

- Messages

- 7,296

- Reaction score

- 7,775

- Points

- 113

The basket of deplorables strike again...

Deplorable? 69-year-old woman punched in face by Trump supporter outside NC rally

http://wlos.com/news/local/69-year-old-woman-punched-in-face-outside-rally-by-trump-supporter

And yet all those Bernie supporters that rioted, battered Trump supporters and blocked highways drew no condemnation from you Tibs. I have my doubts that this guy was even a Trump suporter and not a paid Soros agitator planted by the DNC.

God, I'm going to miss President Obama. A living legend.

Obama Eviscerates Trump as a Fake Working Class Hero

http://www.motherjones.com/politics/2016/09/obama-donald-trump-philadelphia-rally

While the entire 40 min video is well worth watching, Obama comments on the decline of the GOP at the 8:30 mark "This isn't Abraham Lincoln's Republican Party...this isn't Reagan's vision, this is a dark, pessimistic vision..."

Then begins his masterful takedown of Trump from 18:00 on..."I keep on reading this analysis that Trump's got support from working folks—really? This is the guy you want to be championing working people? This guy who spent 70 years on this earth showing no concern for working people? This guy's suddenly going to be your champion? He spent most of his life trying to stay as far away from working people as he could."

My personal favorite is Obama outing Trump as Putin's lapdog, which is at 21:50 if you want to skip ahead and get to the good stuff.

Obama has killed the working class and lower class. The middle class and lower class and the African Americans are doing way worse under he and Hilldog's policies. Any Dem that says otherwise truly is a blind libtard. The numbers are the facts and they can't be denied.

I know what his rates are. But, what I am saying is that if he pays anything less than the very top tax percentage, the media will eviscerate him. And, as I stated, I guarantee, with deductions, etc. he doesn't pay anywhere near the percentage you quoted. No one in their right mind does. They find and take every possible deduction they can. Charity is one of them. However, as I also stated, Trump donates millions anonymously and does not include those on his taxes and does not get a tax break for them. But, no one will care about that unless (and even then) he publishes that with his tax return release.Uhhhh, no. He is a New York resident, pays state taxes, and is at the top rate of 39% for Federal taxes. He pays a ****-ton of taxes.

I believe that the concern is that his charitable donations are not "x" percent of his income, and the fact that he deducts mortgage payments on a ton of homes. Not a good look for a Presidential candidate.

I have to laugh my *** off at my brainwashed libtards who keep posting/regurgitating this "Well, at least now Republicans are concerned about a woman's health." It's lame as hell and false.

- Joined

- Apr 20, 2014

- Messages

- 24,914

- Reaction score

- 11,537

- Points

- 113

Where’s old sickly Hillary?

In bed.Hit her while she's down!

Kick her in the gut!

Donald Trump To Tour Flint Water Crisis Facilities

NEW YORK CITY, New York—Donald Trump, the Republican nominee for president, is upstaging Democratic presidential nominee Hillary Rodham Clinton yet again on Wednesday, this time with a visit to Flint, Michigan, to tour the city’s infamous water facilities in crisis

http://www.detroitnews.com/story/news/politics/2016/09/13/trump-flint/90305256/

In bed.Hit her while she's down!

Kick her in the gut!

Donald Trump To Tour Flint Water Crisis Facilities

NEW YORK CITY, New York—Donald Trump, the Republican nominee for president, is upstaging Democratic presidential nominee Hillary Rodham Clinton yet again on Wednesday, this time with a visit to Flint, Michigan, to tour the city’s infamous water facilities in crisis

http://www.detroitnews.com/story/news/politics/2016/09/13/trump-flint/90305256/

- Joined

- Apr 20, 2014

- Messages

- 24,914

- Reaction score

- 11,537

- Points

- 113

Pay to play for the 1%ers!

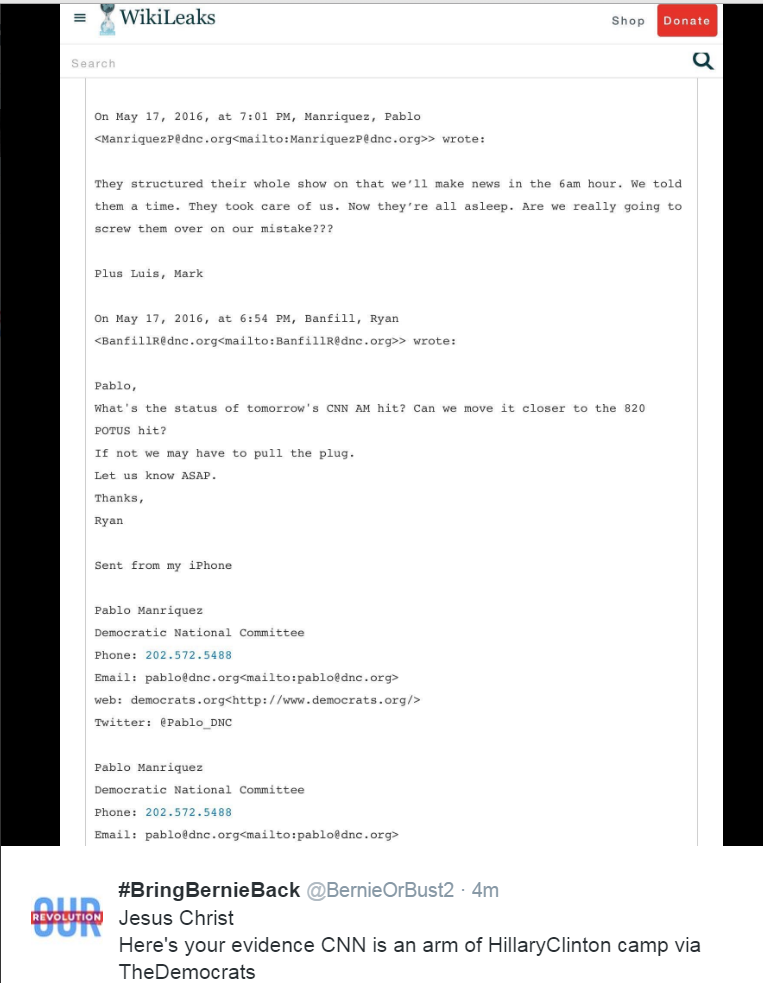

Bernie fans must be having a **** fit

well, the ones with a conscience

Last edited:

wtf?

That's not very nice - we don't wish death on fellow Steelers fans!

I'm just kidding. Surely he knows that by now.

CHILD CARE REFORMS THAT WILL MAKE AMERICA GREAT AGAIN

Fact Sheet for Donald J. Trump's New Child Care Plan: Click Here

Current Policies Hold Families Back

Over the past 40 years, the labor force participation of women with children under 18 has grown from 47 percent in 1975 to 70 percent today. Raising a child is now the single greatest expense for most American families—even exceeding the cost of housing in much of the country. Almost two-thirds (64 percent) of mothers with children under 6 are working outside of the home.

Government policies are stuck in the past, and make already difficult choices regarding care arrangements even more difficult. Outdated policies in many cases cause women to make choices that are not the best for either their families or the economy.

Today’s workforce includes 73.5 million women representing 47 percent of the entire US labor force. Over 24 million of those women have children under age 18; almost 10 million of them have children under age 6. Women are the primary breadwinners in 40 percent of American households with children under the age of 18, but hold 62 percent of minimum wage jobs. The number of families headed by single mothers has doubled in the last 30 years; about two-thirds of these mothers work in “dead-end, poorly compensated jobs without flexibility or benefits.” Government policies must be especially helpful for these women.

Current federal policies regarding child and dependent care do not reflect either the needs of American families or the contributions of women to the American workforce. The high cost of quality care burdens working families while the tax code provides disincentives for women to reenter or enter the workforce.

Our plan will transform child and dependent care to meet the needs of 21st century families, empowering parents—not bureaucrats.

The Trump Plan Will Empower Parents and Achieve the Following Goals:

1. Help every family with the costs of childcare and eldercare.

2. Empower families to choose the care that is right for their family.

3. Create a new, dynamic market for family-based and community-based solutions.

4. Incentivize employers to provide childcare at the workplace.

5. Provide 6 weeks of paid leave to new mothers before returning to work.

Details of Donald J. Trump’s Plan for Child and Dependent Care:

Exclude the costs of child and elder care from tax

In a world where almost two-thirds of mothers with children under age 6 are employed, the cost of childcare is an unavoidable family expense. In business, other such expenditures are tax-deductible, but they are not for families. The Trump plan will exclude childcare costs from the income tax from birth to age 13, the period where children need supervised care, and will include adoptive parents as well as foster parents who are legal guardians of the child. The exclusion (also known as an above-the-line deduction) will cover up to 4 children per family.

The exclusion would apply to a variety of different kinds of childcare—institutional, private, nursery school, afterschool care, and enrichment activities—affording choice to parents. The deduction would be limited to the average cost of childcare in the state of residence for the age of the child.

Importantly, the benefit would be provided to families who use stay-at-home parents or grandparents as well as those who use paid caregivers. This would level the playing field for parents when it comes to determining what’s in a family’s best interest. It would also be a belated recognition by the federal government of the economic value of the work provided by stay-at-home parents.

Similarly, the Trump plan would also allow an above-the-line deduction for eldercare costs necessary to keep a family member working outside the home. It would apply to costs like home care or adult day care costs for elderly dependents when those expenses are needed to keeping family members in the workforce. The deduction would be limited to $5,000 per year.

While an above-the-line deduction is a significant tax benefit, it may not provide sufficient relief to the lowest-earning taxpayers. To get real benefits to lower-income taxpayers who can't use the exclusion against the income tax because they have no income tax liability, the Trump plan would also provide them a boost in the Earned Income Tax Credit (EITC). This boost would be half of the payroll taxes paid by the lower earning parent, and would be subject to an income limitation of $31,200.

For a parent making $15 per hour at a full-time job, the EITC boost in the Trump plan could mean as much as $1,200 extra per year. Importantly, when parents fill out their taxes they can check a box to directly deposit any portion of their EITC into their childcare savings account (discussed in more detail below). This will encourage saving, and make it easier for low-income parents to receive their federal match.

Allowing every family, whether they take the standard or itemized deduction, to deduct childcare expenses from tax will help get the incentives right for women who opt to work outside the home. The current tax code discourages their work.

The tax code combines the income of both spouses in a family when determining the marginal tax rate, so the additional income earned by a mother who returns to the workforce is taxed at the highest rate that applies to the family. The above-the-line deduction for child and elder care mitigates this effect.

Experts agree that childcare is properly expensed to ameliorate the effects of a tax code written over 65 years ago for a workforce that no longer exists. Dual-earner families were not prevalent in 1949 when the current tax regime for families was put in place. Today, however, almost two-thirds of married couples are dual-earners, more than twice the number of single-earner married couples.

As AEI economist Alan Viard put it, “Under basic tax policy principles, workers should be allowed to deduct the expenses of earning the income on which they are taxed. Child care meets the economic definition of a work-related expense — parents are less likely to work when child care becomes more expensive....Families should be free to make their own child care choices, based on the options available to them, their understanding of their children’s needs, and their moral values, without interference from the tax system.”

Changes in the family, workforce, and the large proportion of women who work outside the home require us to fix the broken tax code. Excluding the costs of childcare from taxation will help every family with the costs of child and dependent care. The Trump plan will promote strong families and grow the workforce, which will increase productivity and spur economic growth. Most importantly, it will provide families real choice in making decisions about how to provide care for their loved ones.

Create Child Care Savings Accounts

After finding the right care for their circumstances, families should also have an option to set aside extra money to further foster their child’s development. The Trump plan will provide Americans the option of opening dependent care savings accounts (DCSAs) so that they can plan for future expenses relating to child and elder care.

Annual contributions to a dependent care savings account and earnings on the account will not be subject to tax. Immediate family members and employers will also be able to set aside funds in these accounts, which will be established for the benefit of specific individuals, including unborn children. Total contributions could not exceed $2,000 per year from all sources, but balances in a DCSA will rollover from year-to-year so that substantial amounts could be accumulated over a period of years.

When established for a child, parents can use the accumulated funds to enroll their kids in a school of their choice or for other enrichment activities that prepare them for their future. Funds remaining in the account when the child reaches 18 can be used for higher education expenses. To encourage low-income families to establish DCSAs for their children, the government will provide a 50 percent match on parental contributions of up to $1,000 per year. That’s an extra $500 per child for families that qualify. This will encourage savings, and position families to be better able to withstand the unexpected costs of childrearing.

When established for an elderly dependent, the funds can be used for adult day care, in-home or long-term care services. The ability to set aside funds tax-free would be particularly helpful to women, low-income workers and minorities, who are typically primary care providers that reduce paid time worked in order to provide care. The ability to set aside funds for elder care is critically important because taking time off from working to care for elderly family members reduces a woman’s financial readiness for retirement, and can increase a woman’s risk of living in poverty in old age.

The flexibility and security provided by the dependent care savings account under the Trump plan will be of great benefit to all who participate, enabling them to save tax-free for the expected costs of family life. Additionally, this will help increase the low US savings rate (currently 5.7 percent), where 47 percent of Americans cannot meet an unexpected expense of $400 without resorting to borrowing or selling personal property.

Create a new, dynamic market for family-based and community-based solutions

Finding quality childcare is a challenge, particularly in low-income and rural communities. The Trump plan will reduce regulations that disproportionately favor center-based care to create a new, dynamic market for family-based and community-based solutions. Families will be given the power and information to choose who will be providing care and where that care will be provided without fear of loss of government benefits. The marketplace will be free to develop alternatives that provide care where needed, and at the times when people who work irregular hours need care.

Current federal efforts to reduce childcare costs, such as the pre-tax flexible spending accounts available to many workers, are biased toward center-based care. The lack of choice limits options for people who work irregular hours and those who live in rural communities where choices for center-based care are not available nearby. Federal regulations already in the pipeline likely will limit choices further. Devolving regulatory authority to the states to set guidelines appropriate to the needs of its residents for items like staffing and facility size would be a priority in the Trump administration.

As the Independent Women’s Forum put it in a recent report: “Analysts have found that day-care regulations, particularly related to child-to-staff ratios, are costly and fail to improve the quality of care received by the children. Moreover, they may be counterproductive since they require day-care providers to focus on quantity of caregivers, rather than the quality of those professionals. State policymakers should relax staff size regulations so that day-care centers can reallocate funds to other priorities, such as attracting and retaining more highly-skilled workers, and reducing prices for parents.”

In addition, informal networks of friends and relatives are an important source of childcare that is convenient and trusted. These flexible arrangements can also help meet the need for care during nontraditional hours. Moms helping moms and grandparents caring for children should be facilitated not discouraged. The costs of such care will be excluded from tax under the Trump plan if allowed by the state.

Reducing regulations to allow the market to work will result in innovative solutions that meet the particular circumstances faced by families in the communities where they live. Such solutions will not be arrived at through Washington bureaucracy and a one-size-fits-all solution.

Incentivize employers to provide childcare at the workplace

The 2014 National Survey of Employers found that only 7 percent of employers offered childcare at or near the worksite. The Trump plan will incentivize employers to provide childcare at the workplace by making the existing tax credit for employer-based childcare facilities more effective, and will allow the same income tax exclusion allowed to individuals to businesses that contribute to an employees’ cost of childcare.

Legislation enacted in 2001 included a bipartisan incentive for on-site childcare. That law gave companies that provide appropriately-licensed on-site childcare centers a tax credit of up to 25 percent of facility expenditures, plus 10 percent of resource and referral costs, up to a limit of $150,000 per calendar year; a portion of the credit is recaptured if the center is kept in service for less than 10 tax years. The Trump plan would increase the cap, shorten the recapture period, and devise ways for companies to pool resources in order to make the credit more attractive.

Because breakdowns in employee childcare networks of care cost U.S. businesses $4.4 billion annually as a consequence of avoidable employee absenteeism, both businesses and families will benefit from the increased availability of convenient, reliable, care. On-site child care centers save employees time—as much as 30 minutes per morning—which will ultimately be to the employers’ benefit as parents are more productive knowing that their children are accessible to them in case of an emergency. Such facilities could also provide back-up or emergency care for employees with family-based or in-home care.

Further, allowing businesses the same exclusion from income for their contributions to their employees’ childcare will give businesses the opportunity to provide a benefit that helps their employees remain in the workforce. This may be particularly attractive to small businesses that are unable to provide worksite care and take full advantage of the tax credit for on-site childcare centers.

Enabling businesses to make it more convenient for parents with children to work makes good business sense, and helps all working women.

Provide 6 weeks of maternity leave to new mothers

The United States is the only developed country that does not provide cash benefits for new mothers. According to the U.S. Department of Labor: “Only 12 percent of U.S. private sector workers have access to paid family leave through their employer”. Each year, 1.4 million women who work give birth without any paid leave from their employer.

The Trump plan will enhance Unemployment Insurance (UI) to include 6 weeks of paid leave for new mothers so that they can take time off of work after having a baby. This would triple the average 2 weeks of paid leave received by new mothers, which will benefit both the mother and the child.

Providing a temporary unemployment benefit for eight weeks through the UI system would cost $2.5 billion annually at an average benefit of $300 per week. This cost could be offset through changes in the existing UI system, such as by reducing the $5.6 billion per year in improper payments or implementing the proposals included in the administration’s FY 2017 budget regarding program integrity. Providing the benefit through UI—paid for through program savings—will not be financially onerous to small businesses when compared with mandating paid leave.

An analysis of a similar program in California has shown that unmarried, nonwhite, and non-college educated mothers receive the most benefit. The Trump plan for paid maternity leave will advance the interests of disadvantaged mothers without raising taxes.

The Trump plan promotes economic freedom for women

Families make decisions about whether to work outside of the home or not based on the cost and availability of child and elder care. Many women stop paid work to provide care because other options are not readily available. This often limits their careers, and is fundamental to the wage disparities that women face. As noted above, in 2014, single women without children made 94 cents on a man’s dollar, but married mothers with children under 18 made only 81 cents.

A one-size-fits-all solution ignores the reality of today’s modern family dynamics. It is essential to empower women who choose to work outside the home to do so, without penalty, while also supporting women who make the important choice to work inside the home, caring for their families.

Child and elder care policies proposed under the Trump Plan will foster economic and family growth. Policies like paid maternity leave, treating childcare like a business expense, and enabling innovative care models will keep women in the workforce if that is what she chooses. Retaining women in the workforce is essential, not just for the woman’s benefit but for that of her family, her employer, her community and her country—helping to Make America Great Again.

Fact Sheet for Donald J. Trump's New Child Care Plan: Click Here

Current Policies Hold Families Back

Over the past 40 years, the labor force participation of women with children under 18 has grown from 47 percent in 1975 to 70 percent today. Raising a child is now the single greatest expense for most American families—even exceeding the cost of housing in much of the country. Almost two-thirds (64 percent) of mothers with children under 6 are working outside of the home.

Government policies are stuck in the past, and make already difficult choices regarding care arrangements even more difficult. Outdated policies in many cases cause women to make choices that are not the best for either their families or the economy.

Today’s workforce includes 73.5 million women representing 47 percent of the entire US labor force. Over 24 million of those women have children under age 18; almost 10 million of them have children under age 6. Women are the primary breadwinners in 40 percent of American households with children under the age of 18, but hold 62 percent of minimum wage jobs. The number of families headed by single mothers has doubled in the last 30 years; about two-thirds of these mothers work in “dead-end, poorly compensated jobs without flexibility or benefits.” Government policies must be especially helpful for these women.

Current federal policies regarding child and dependent care do not reflect either the needs of American families or the contributions of women to the American workforce. The high cost of quality care burdens working families while the tax code provides disincentives for women to reenter or enter the workforce.

Our plan will transform child and dependent care to meet the needs of 21st century families, empowering parents—not bureaucrats.

The Trump Plan Will Empower Parents and Achieve the Following Goals:

1. Help every family with the costs of childcare and eldercare.

2. Empower families to choose the care that is right for their family.

3. Create a new, dynamic market for family-based and community-based solutions.

4. Incentivize employers to provide childcare at the workplace.

5. Provide 6 weeks of paid leave to new mothers before returning to work.

Details of Donald J. Trump’s Plan for Child and Dependent Care:

Exclude the costs of child and elder care from tax

In a world where almost two-thirds of mothers with children under age 6 are employed, the cost of childcare is an unavoidable family expense. In business, other such expenditures are tax-deductible, but they are not for families. The Trump plan will exclude childcare costs from the income tax from birth to age 13, the period where children need supervised care, and will include adoptive parents as well as foster parents who are legal guardians of the child. The exclusion (also known as an above-the-line deduction) will cover up to 4 children per family.

The exclusion would apply to a variety of different kinds of childcare—institutional, private, nursery school, afterschool care, and enrichment activities—affording choice to parents. The deduction would be limited to the average cost of childcare in the state of residence for the age of the child.

Importantly, the benefit would be provided to families who use stay-at-home parents or grandparents as well as those who use paid caregivers. This would level the playing field for parents when it comes to determining what’s in a family’s best interest. It would also be a belated recognition by the federal government of the economic value of the work provided by stay-at-home parents.

Similarly, the Trump plan would also allow an above-the-line deduction for eldercare costs necessary to keep a family member working outside the home. It would apply to costs like home care or adult day care costs for elderly dependents when those expenses are needed to keeping family members in the workforce. The deduction would be limited to $5,000 per year.

While an above-the-line deduction is a significant tax benefit, it may not provide sufficient relief to the lowest-earning taxpayers. To get real benefits to lower-income taxpayers who can't use the exclusion against the income tax because they have no income tax liability, the Trump plan would also provide them a boost in the Earned Income Tax Credit (EITC). This boost would be half of the payroll taxes paid by the lower earning parent, and would be subject to an income limitation of $31,200.

For a parent making $15 per hour at a full-time job, the EITC boost in the Trump plan could mean as much as $1,200 extra per year. Importantly, when parents fill out their taxes they can check a box to directly deposit any portion of their EITC into their childcare savings account (discussed in more detail below). This will encourage saving, and make it easier for low-income parents to receive their federal match.

Allowing every family, whether they take the standard or itemized deduction, to deduct childcare expenses from tax will help get the incentives right for women who opt to work outside the home. The current tax code discourages their work.

The tax code combines the income of both spouses in a family when determining the marginal tax rate, so the additional income earned by a mother who returns to the workforce is taxed at the highest rate that applies to the family. The above-the-line deduction for child and elder care mitigates this effect.

Experts agree that childcare is properly expensed to ameliorate the effects of a tax code written over 65 years ago for a workforce that no longer exists. Dual-earner families were not prevalent in 1949 when the current tax regime for families was put in place. Today, however, almost two-thirds of married couples are dual-earners, more than twice the number of single-earner married couples.

As AEI economist Alan Viard put it, “Under basic tax policy principles, workers should be allowed to deduct the expenses of earning the income on which they are taxed. Child care meets the economic definition of a work-related expense — parents are less likely to work when child care becomes more expensive....Families should be free to make their own child care choices, based on the options available to them, their understanding of their children’s needs, and their moral values, without interference from the tax system.”

Changes in the family, workforce, and the large proportion of women who work outside the home require us to fix the broken tax code. Excluding the costs of childcare from taxation will help every family with the costs of child and dependent care. The Trump plan will promote strong families and grow the workforce, which will increase productivity and spur economic growth. Most importantly, it will provide families real choice in making decisions about how to provide care for their loved ones.

Create Child Care Savings Accounts

After finding the right care for their circumstances, families should also have an option to set aside extra money to further foster their child’s development. The Trump plan will provide Americans the option of opening dependent care savings accounts (DCSAs) so that they can plan for future expenses relating to child and elder care.

Annual contributions to a dependent care savings account and earnings on the account will not be subject to tax. Immediate family members and employers will also be able to set aside funds in these accounts, which will be established for the benefit of specific individuals, including unborn children. Total contributions could not exceed $2,000 per year from all sources, but balances in a DCSA will rollover from year-to-year so that substantial amounts could be accumulated over a period of years.

When established for a child, parents can use the accumulated funds to enroll their kids in a school of their choice or for other enrichment activities that prepare them for their future. Funds remaining in the account when the child reaches 18 can be used for higher education expenses. To encourage low-income families to establish DCSAs for their children, the government will provide a 50 percent match on parental contributions of up to $1,000 per year. That’s an extra $500 per child for families that qualify. This will encourage savings, and position families to be better able to withstand the unexpected costs of childrearing.

When established for an elderly dependent, the funds can be used for adult day care, in-home or long-term care services. The ability to set aside funds tax-free would be particularly helpful to women, low-income workers and minorities, who are typically primary care providers that reduce paid time worked in order to provide care. The ability to set aside funds for elder care is critically important because taking time off from working to care for elderly family members reduces a woman’s financial readiness for retirement, and can increase a woman’s risk of living in poverty in old age.

The flexibility and security provided by the dependent care savings account under the Trump plan will be of great benefit to all who participate, enabling them to save tax-free for the expected costs of family life. Additionally, this will help increase the low US savings rate (currently 5.7 percent), where 47 percent of Americans cannot meet an unexpected expense of $400 without resorting to borrowing or selling personal property.

Create a new, dynamic market for family-based and community-based solutions

Finding quality childcare is a challenge, particularly in low-income and rural communities. The Trump plan will reduce regulations that disproportionately favor center-based care to create a new, dynamic market for family-based and community-based solutions. Families will be given the power and information to choose who will be providing care and where that care will be provided without fear of loss of government benefits. The marketplace will be free to develop alternatives that provide care where needed, and at the times when people who work irregular hours need care.

Current federal efforts to reduce childcare costs, such as the pre-tax flexible spending accounts available to many workers, are biased toward center-based care. The lack of choice limits options for people who work irregular hours and those who live in rural communities where choices for center-based care are not available nearby. Federal regulations already in the pipeline likely will limit choices further. Devolving regulatory authority to the states to set guidelines appropriate to the needs of its residents for items like staffing and facility size would be a priority in the Trump administration.

As the Independent Women’s Forum put it in a recent report: “Analysts have found that day-care regulations, particularly related to child-to-staff ratios, are costly and fail to improve the quality of care received by the children. Moreover, they may be counterproductive since they require day-care providers to focus on quantity of caregivers, rather than the quality of those professionals. State policymakers should relax staff size regulations so that day-care centers can reallocate funds to other priorities, such as attracting and retaining more highly-skilled workers, and reducing prices for parents.”

In addition, informal networks of friends and relatives are an important source of childcare that is convenient and trusted. These flexible arrangements can also help meet the need for care during nontraditional hours. Moms helping moms and grandparents caring for children should be facilitated not discouraged. The costs of such care will be excluded from tax under the Trump plan if allowed by the state.

Reducing regulations to allow the market to work will result in innovative solutions that meet the particular circumstances faced by families in the communities where they live. Such solutions will not be arrived at through Washington bureaucracy and a one-size-fits-all solution.

Incentivize employers to provide childcare at the workplace

The 2014 National Survey of Employers found that only 7 percent of employers offered childcare at or near the worksite. The Trump plan will incentivize employers to provide childcare at the workplace by making the existing tax credit for employer-based childcare facilities more effective, and will allow the same income tax exclusion allowed to individuals to businesses that contribute to an employees’ cost of childcare.

Legislation enacted in 2001 included a bipartisan incentive for on-site childcare. That law gave companies that provide appropriately-licensed on-site childcare centers a tax credit of up to 25 percent of facility expenditures, plus 10 percent of resource and referral costs, up to a limit of $150,000 per calendar year; a portion of the credit is recaptured if the center is kept in service for less than 10 tax years. The Trump plan would increase the cap, shorten the recapture period, and devise ways for companies to pool resources in order to make the credit more attractive.

Because breakdowns in employee childcare networks of care cost U.S. businesses $4.4 billion annually as a consequence of avoidable employee absenteeism, both businesses and families will benefit from the increased availability of convenient, reliable, care. On-site child care centers save employees time—as much as 30 minutes per morning—which will ultimately be to the employers’ benefit as parents are more productive knowing that their children are accessible to them in case of an emergency. Such facilities could also provide back-up or emergency care for employees with family-based or in-home care.

Further, allowing businesses the same exclusion from income for their contributions to their employees’ childcare will give businesses the opportunity to provide a benefit that helps their employees remain in the workforce. This may be particularly attractive to small businesses that are unable to provide worksite care and take full advantage of the tax credit for on-site childcare centers.

Enabling businesses to make it more convenient for parents with children to work makes good business sense, and helps all working women.

Provide 6 weeks of maternity leave to new mothers

The United States is the only developed country that does not provide cash benefits for new mothers. According to the U.S. Department of Labor: “Only 12 percent of U.S. private sector workers have access to paid family leave through their employer”. Each year, 1.4 million women who work give birth without any paid leave from their employer.

The Trump plan will enhance Unemployment Insurance (UI) to include 6 weeks of paid leave for new mothers so that they can take time off of work after having a baby. This would triple the average 2 weeks of paid leave received by new mothers, which will benefit both the mother and the child.

Providing a temporary unemployment benefit for eight weeks through the UI system would cost $2.5 billion annually at an average benefit of $300 per week. This cost could be offset through changes in the existing UI system, such as by reducing the $5.6 billion per year in improper payments or implementing the proposals included in the administration’s FY 2017 budget regarding program integrity. Providing the benefit through UI—paid for through program savings—will not be financially onerous to small businesses when compared with mandating paid leave.

An analysis of a similar program in California has shown that unmarried, nonwhite, and non-college educated mothers receive the most benefit. The Trump plan for paid maternity leave will advance the interests of disadvantaged mothers without raising taxes.

The Trump plan promotes economic freedom for women

Families make decisions about whether to work outside of the home or not based on the cost and availability of child and elder care. Many women stop paid work to provide care because other options are not readily available. This often limits their careers, and is fundamental to the wage disparities that women face. As noted above, in 2014, single women without children made 94 cents on a man’s dollar, but married mothers with children under 18 made only 81 cents.

A one-size-fits-all solution ignores the reality of today’s modern family dynamics. It is essential to empower women who choose to work outside the home to do so, without penalty, while also supporting women who make the important choice to work inside the home, caring for their families.

Child and elder care policies proposed under the Trump Plan will foster economic and family growth. Policies like paid maternity leave, treating childcare like a business expense, and enabling innovative care models will keep women in the workforce if that is what she chooses. Retaining women in the workforce is essential, not just for the woman’s benefit but for that of her family, her employer, her community and her country—helping to Make America Great Again.

Lots of other people read this stuff and never post. Personal attacks are wrong.

Yeah, but they're fun.

- Joined

- Apr 20, 2014

- Messages

- 24,914

- Reaction score

- 11,537

- Points

- 113

I better re-post this - it's Headline News worthy

Trump Has 5-Point Lead in Bloomberg Poll of Battleground Ohio

Donald Trump leads Hillary Clinton by 5 percentage points in a Bloomberg Politics poll of Ohio, a gap that underscores the Democrat’s challenges in critical Rust Belt states after one of the roughest stretches of her campaign.

The Republican nominee leads Clinton 48 percent to 43 percent among likely voters in a two-way contest and 44 percent to 39 percent when third-party candidates are included.

http://www.bloomberg.com/politics/ar...9-14/ohio-poll

-----------------------------------

It's over

Trump Has 5-Point Lead in Bloomberg Poll of Battleground Ohio

Donald Trump leads Hillary Clinton by 5 percentage points in a Bloomberg Politics poll of Ohio, a gap that underscores the Democrat’s challenges in critical Rust Belt states after one of the roughest stretches of her campaign.

The Republican nominee leads Clinton 48 percent to 43 percent among likely voters in a two-way contest and 44 percent to 39 percent when third-party candidates are included.

http://www.bloomberg.com/politics/ar...9-14/ohio-poll

-----------------------------------

It's over

Especially since Bloomberg polls mostly democrats.

- Joined

- Apr 8, 2014

- Messages

- 1,022

- Reaction score

- 585

- Points

- 113

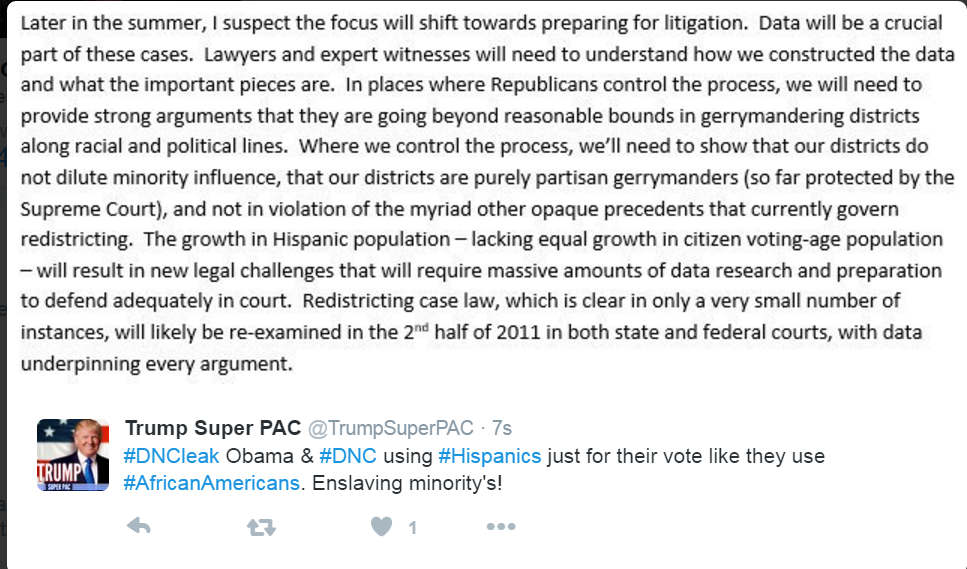

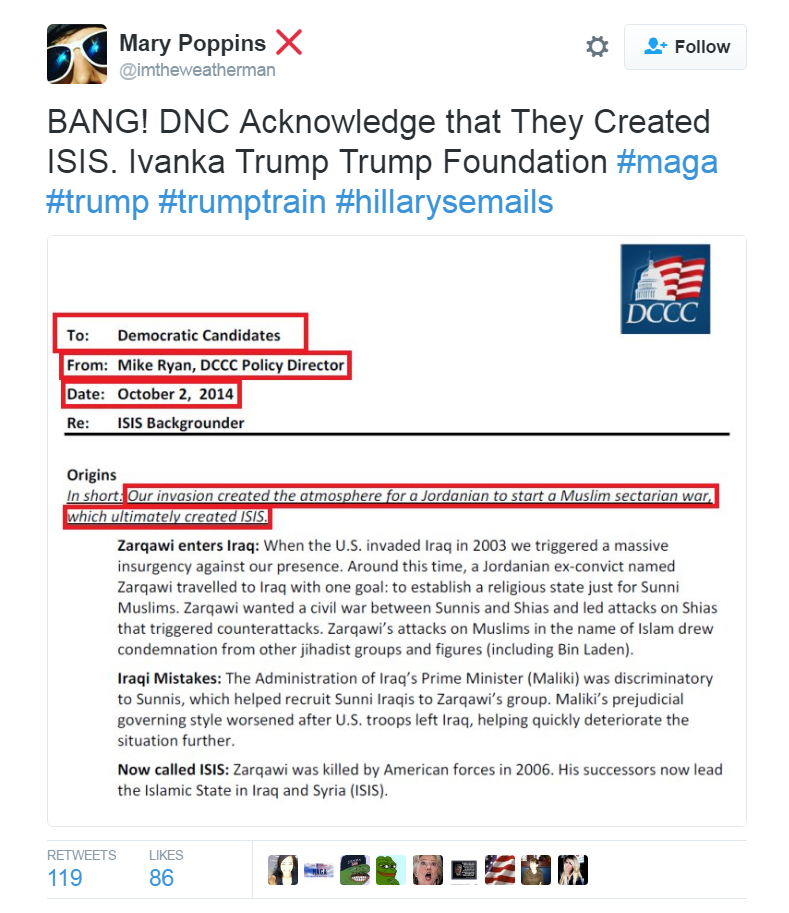

This one is pretty stupid. DNC saying "Our invasion of Iraq" in 2003 -- when GWB led the charge. It's more of stating that the US as a country created ISIS, not the Democrats.

Nice...

14 Medal of Honor recipients publicly backed Donald Trump’s presidential bid this week, just days after Trump received the endorsement of 88 retired military figures.

Pat Brady, who received the Medal of Honor for his heroic service during the Vietnam War, appeared on "Fox and Friends" this morning to explain why he's backing Trump

- Status

- Not open for further replies.