It's Brilliant...Here’s the Clever Reason Why Trump May Wait Until Jan to Sign Tax Bill

President Trump may not sign the tax bill until January even after congressional Republicans passed it in a rush to get it to the White House before Christmas, his top economic adviser said Tuesday.

Rather, the administration may hold off on signing the bill into law in order to avoid an awkward vote on spending cuts that would be mandated under pay-as-you-go law. If Trump signs the bill in 2018 rather than 2017, he would avoid that vote for another year and take a leverage point away from Democrats.

“There’s a technical issue on something called ‘paygo,’” National Economic Council director Gary Cohn said Wednesday morning at a public interview with the publication Axios.

Paygo requires that tax cuts added to the deficit be offset with with mandatory spending cuts to certain government programs. Congress wouldn’t have control over those cuts, and they would cut deeply into Medicare, farm subsidies, and other government programs. Neither Democrats nor Republicans would favor those cuts.

GOP leaders have reassured lawmakers that the automatic cuts will be waived.

If they can get the cuts waived as part of the spending bill needed this week to keep the government open, “we will sign the tax bill this year,” Cohn said.

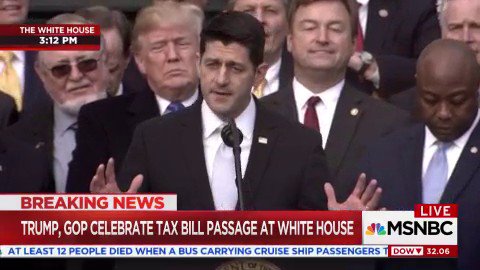

Trump plans to hold an event Wednesday afternoon at the White House to mark the passage of the tax bill, after the House of Representatives re-votes on it. But the event would not be a bill signing.

Keeping that in mind, Trump may wait to sign the new tax bill until January, to avoid a vote on spending cuts.

http://truthfeednews.com/heres-the-clever-reason-why-trump-may-wait-until-jan-to-sign-tax-bill/ via @truthfeednews

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/XQFA2S535FFQVHSJ7QMRDANU4E.jpg)