An old Mel Gibson movie comes to mind.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Official Thread Dedicated to "Biden Destroying Us"

- Thread starter Tim Steelersfan

- Start date

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

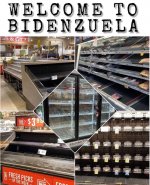

Update on the genius of Sloppy Joe and his brave steps to "solve" supply chain issues:

www.nationalreview.com

www.nationalreview.com

In closing, Let's Go, Brandon!!

The Supply-Chain Crisis Never Went Away

Just because the national media stop paying attention to a problem doesn’t mean that problem goes away. Unless you are professionally required to keep track of supply-chain issues, you probably haven’t heard much about that crisis since people finished their Christmas shopping. Back on December 22, White House chief of staff Ron Klain shared a New York Times article and declared that supply-chain problems were “an over-hyped narrative.”

In fact, also on that day, President Biden declared that the supply-chain crisis had been solved: “Earlier this fall, we heard a lot of dire warnings about supply chain problems leading to a crisis around the holidays, so we acted. . . . We brought together business and labor leaders to solve problems. And much — you know, the much-predicted crisis didn’t occur. Packages are moving. Gifts are being delivered. Shelves are not empty.”

And yet, you may have noticed that your local store shelves still aren’t restocked to their usual levels, or you may well be finding empty shelves.

From the Richmond, Va., ABC affiliate:

From the Atlanta CBS affiliate:It could be a dry January for some people, whether they were planning on it or not as Virginia ABC stores around the state are still struggling to fill shelves. At the ABC store at Stonebridge Plaza in Chesterfield, customers found row after row of empty shelves. Tawni Schilling, a shopper at the store, said her favorite spirits have been out of stock since November.

From the Portland, Ore., CBS affiliate:It’s a sight that greets many going for their weekly grocery shop, empty store shelves.

“It’s just random things, things I just wouldn’t even think of. Today there was no potatoes, not a lot of meat,” said a father shopping at Kroger. With the holidays over, many told CBS46 they thought things might look a little better, but still empty shelves persist.

CBS46 reporter Jamie Kennedy checked out Publix, which was nearly depleted of toilet paper and salad mixes.

Over at Kroger, certain vegetables and kids’ juice were mainly out of stock.

From the Knoxville, Tenn., CBS affiliate:If you went grocery shopping over the weekend, there’s a good chance you noticed some shelves looking pretty bare. . . . Empty shelves were seen around at least two different Fred Meyer stores in Oregon this weekend, along with signs posted that read, ‘Severe weather has caused shipping issues, these items are temporarily out of stock.’ Eggs, yogurt and milk were just a few of the items in short supply.

Near Daytona Beach, Fla.:Thomas Goldsby researches shortages, like this one, for the University of Tennessee. As a supply chain management expert, he said every category is getting affected, not just cereal or other products. ‘We’ve been pretty hampered by cold weather and snow, but also those tornadoes that struck back in December have limited our ability to meet our needs too,’ said Goldsby. . . . The Tennessee Grocers & Convenience Store Association President, Rob Ikard, said it’s been a tough couple of weeks.

From KHOU in Houston: “People across the Houston area seem to be having the same problem. They’re running into near-empty cold and flu medicine shelves at local pharmacies.”From sports drinks to cereal and cat food, many common staples are increasingly missing from grocery store shelves in Volusia County, a reflection of continuing supply chain issues tied to the ongoing COVID-19 pandemic.

It’s a similar story in Dallas:

You can find similar stories from Honolulu; Cape Cod and Watertown, Mass.; and in Washington state, although those empty shelves are more directly connected to bad weather disrupting transportation.If you find yourself fighting a cold or cough in coming days, be prepared to drive to several stores to find common over-the-counter remedies. Spot checks of eight Walmart, Target, Walgreens, CVS and Sam’s Club locations in northeast Dallas on Monday found some with empty shelves while others had fast-going supplies.

And it’s not just groceries.

From the Wall Street Journal:

In Springfield, Mo.:Pandemic-related factory closures, transportation delays and port-capacity limits have stymied the flow of many goods and materials critical for home building, including windows, garage doors, appliances and paint.

Hammer’s Autoworks vice president of operations Aaron Bruton says it’s starting with manufacturers not being able to get materials. Then, it trickles down to staffing shortages at the production level.

In Hardin County, Texas:

When you add up all of these reports, it seems like a lot of genuine and glaring problems for the White House chief of staff to dismiss as just “an overhyped narrative”!“We are facing a shortage of CDL drivers due to the nationwide shortage and COVID,” Deputy Judge-Executive Daniel London said in the release. “Making the situation more challenging, we ordered six new replacement dump trucks, which haven’t yet been delivered due to the nationwide supply chain constraints. We ask for patience and understanding as we push through the snow event.”

As with the border, inflation, the Afghanistan withdrawal, Covid-19, and the shortage of tests, we have to waste time convincing the administration that the country’s problems are actually real problems; the Biden team’s reflexive instinct is that any reports of problems are just right-wing propaganda. (Or perhaps someone like Klain will tell us to be appreciative because we have “high class problems.”)

Empty Shelves Disprove Biden’s Supply-Chain Boasts | National Review

Maybe the hashtag #BareShelvesBiden is being promoted by conservatives, but that doesn’t mean the supply-chain crisis is mythical.

In closing, Let's Go, Brandon!!

Report: Georgia’s largest counties ADMIT they deleted crucial video evidence ahead of ballot harvesting investigation - Right Side Broadcasting Network (RSBN)

Georgia's largest counties admitted last week they no longer possess crucial video camera surveillance footage which monitored drop boxes during the 2020 presidential election. The surveillance footage would have been substantial evidence as Secretary of State Brad Raffensperger launches an...

1933 Germany, anyone? Anyone not seeing the forest through the trees? Build Jan 6 up, use the media and politicians to try to compare it to 9/11, add to that your years and years and years of warnings about domestic terrorism, and combine them to tell the American people we need a special unit created to target domestic terrorism.

Months or years later, what is defined as 'domestic terrorism' quite literally becomes just about any disagreement with any Government rule, law, position and you are labeled.

This is how it starts.

WASHINGTON (AP) — The Justice Department is establishing a specialized unit focused on domestic terrorism, the department’s top national security official told lawmakers Tuesday as he described an “elevated” threat from violent extremists in the United States.

Assistant Attorney General Matthew Olsen, testifying just days after the nation observed the one-year anniversary of the violent insurrection at the U.S. Capitol, said the number of FBI investigations into suspected domestic violent extremists has more than doubled since the spring of 2020.

“We have seen a growing threat from those who are motivated by racial animus, as well as those who ascribe to extremist anti-government and anti-authority ideologies,” Olsen said.

The department’s National Security Division has a counterterrorism section. But Olsen told the Senate that he has decided to create a specialized domestic terrorism unit “to augment our existing approach.”

Months or years later, what is defined as 'domestic terrorism' quite literally becomes just about any disagreement with any Government rule, law, position and you are labeled.

This is how it starts.

DOJ creates special unit to target ‘domestic terrorism’

WASHINGTON (AP) — The Justice Department is establishing a specialized unit focused on domestic terrorism, the department’s top national security official told lawmakers Tuesday as he described an “elevated” threat from violent extremists in the United States.

Assistant Attorney General Matthew Olsen, testifying just days after the nation observed the one-year anniversary of the violent insurrection at the U.S. Capitol, said the number of FBI investigations into suspected domestic violent extremists has more than doubled since the spring of 2020.

“We have seen a growing threat from those who are motivated by racial animus, as well as those who ascribe to extremist anti-government and anti-authority ideologies,” Olsen said.

The department’s National Security Division has a counterterrorism section. But Olsen told the Senate that he has decided to create a specialized domestic terrorism unit “to augment our existing approach.”

Feds will be coming out today or tomorrow on interest rates. Guessing they'll be adjusting them up.

- Joined

- Jun 10, 2014

- Messages

- 11,083

- Reaction score

- 13,239

- Points

- 113

And yet the "official" story is that there was no widespread, significant fraud in the election.

Seriously. EVERY ******* state should just demand photo id for every vote. Absentee, mail-in, in-person. No photo id, no vote. And if you are caught mailing in a false id, you go to jail. Not county jail. State or federal prison in gen pop.

Seriously. EVERY ******* state should just demand photo id for every vote. Absentee, mail-in, in-person. No photo id, no vote. And if you are caught mailing in a false id, you go to jail. Not county jail. State or federal prison in gen pop.

1933 Germany, anyone? Anyone not seeing the forest through the trees? Build Jan 6 up, use the media and politicians to try to compare it to 9/11, add to that your years and years and years of warnings about domestic terrorism, and combine them to tell the American people we need a special unit created to target domestic terrorism.

Months or years later, what is defined as 'domestic terrorism' quite literally becomes just about any disagreement with any Government rule, law, position and you are labeled.

This is how it starts.

DOJ creates special unit to target ‘domestic terrorism’

WASHINGTON (AP) — The Justice Department is establishing a specialized unit focused on domestic terrorism, the department’s top national security official told lawmakers Tuesday as he described an “elevated” threat from violent extremists in the United States.

Assistant Attorney General Matthew Olsen, testifying just days after the nation observed the one-year anniversary of the violent insurrection at the U.S. Capitol, said the number of FBI investigations into suspected domestic violent extremists has more than doubled since the spring of 2020.

“We have seen a growing threat from those who are motivated by racial animus, as well as those who ascribe to extremist anti-government and anti-authority ideologies,” Olsen said.

The department’s National Security Division has a counterterrorism section. But Olsen told the Senate that he has decided to create a specialized domestic terrorism unit “to augment our existing approach.”

Hollywood is certainly doing their part. When the FBI series first came out on CBS, they were enjoyable entertainment. Now every week they're chasing the Whyte Supremes.

Last edited:

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

Pretty good image of Flog/Tibby:

**** you Xiden, you commie piece of ****.

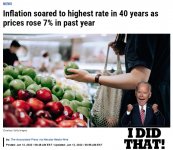

ECONOMY

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

VIDEO04:22

Inflation rises 7% over past year in December, highest in nearly 40 years

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during December, according to a closely watched gauge the Labor Department released Wednesday.

The consumer price index, a gauge that measures costs across dozens of items, increased 7%, according to the department’s Bureau of Labor Statistics. On a monthly basis, CPI increased 0.5%.

Economists surveyed by Dow Jones had been expecting the measure to increase 7% on an annual basis and 0.4% from November.

The annual move was the fastest increase since June 1982.

Despite the strong gain, stock market futures rose following the news while government bond yields were mostly negative.

“The December CPI report of a 7% increase over the last 12 months will be shocking for some investors as we haven’t seen a number that high in nearly 30 years,” said Brian Price, head of investment management for Commonwealth Financial Network. “However, this print was largely anticipated by many, and we can see that reaction in the bond market as longer-term interest rates are declining so far this morning.”

Excluding food and energy prices, so-called core CPI increased 5.5% year over year and 0.6% from the previous month. That compared to estimates of 5.4% and 0.5%. For core inflation, it was the largest annual growth since February 1991.

Shelter costs, which make up nearly one-third of the total rose 0.4% for the month and 4.1% for the year. That was the fastest pace since February 2007.

Used vehicle prices, which have been a major component of the inflation increase during the pandemic due to supply chain constraints that have limited new vehicle production, rose another 3.5% in December, bringing the increase from a year ago to 37.3%.

Conversely, energy prices mostly declined for the month, falling 0.4% as fuel oil was down 2.4% and gasoline fell 0.5%. Still, the complex as a whole rose 29.3% in the 12-month period, including a gain of 49.6% for gasoline.

Federal Reserve officials are watching the inflation data closely and are widely expected to raise interest rates this year in an effort combat rising prices and as the jobs picture approaches full employment. Though the central bank uses the personal consumption expenditures price index as its primary inflation measure, policymakers take in a wide range of information in making decisions.

“This morning’s CPI read really only solidifies what we already know: Consumer wallets are feeling pricing pressures and in turn the Fed has signaled a more hawkish approach. But the question remains if the Fed will pick up the pace given inflation is seemingly here to stay, at least in the medium-term,” said Mike Loewengart, managing director for investment strategy at E*Trade. “With Covid cases continuing to rise, the impact on the supply chain and labor shortages could persist, which only fuels higher prices.”

Inflation has been eating into otherwise strong wage gains for workers. However, real average hourly earnings posted a small 0.1% increase for the month, as the 0.6% total gain outweighed the 0.5% CPI headline increase. On a year-over-year basis, real earnings declined 2.4%, according to BLS calculations.

Fed officials largely attribute rising inflation pressures to pandemic-specific issues in which a shortage of workers has led to clogged supply chains and empty store shelves. Though there are signs that the omicron variant cases could peak soon, lingering Covid issues combined with cold weather in the Northeast point “to renewed upward pressure on food prices,” wrote Paul Ashworth, chief U.S. economist at Capital Economics.

Food prices broadly rose 0.5% for December and were up 6.3% on a 12-month basis, the biggest rise since October 2008.

Investors largely expect the Fed to start raising rates in March. Fed Chairman Jerome Powell, at his confirmation hearing Tuesday before the Senate banking panel, did not provide any specific dates but acknowledged that as long as current conditions persist, rate hikes are on the way.

Markets are pricing a nearly 79% chance for the first quarter-percentage-point increase to come in May, and see about a 50% chance the Fed could enact four such hikes in 2022, according to the CME’s FedWatch Tool.

ECONOMY

Inflation rises 7% over the past year, highest since 1982

PUBLISHED WED, JAN 12 20228:31 AM ESTUPDATED 10 MIN AGOJeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The consumer price index, an inflation gauge that measures costs across dozens of items, rose 7% in December from a year ago, the fastest pace since June 1982.

- That was in line, however, with economist estimates, and stock market futures rose after the release.

- Excluding food and energy, so-called core CPI was up 5.5% on the year, the biggest growth since February 1991.

VIDEO04:22

Inflation rises 7% over past year in December, highest in nearly 40 years

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during December, according to a closely watched gauge the Labor Department released Wednesday.

The consumer price index, a gauge that measures costs across dozens of items, increased 7%, according to the department’s Bureau of Labor Statistics. On a monthly basis, CPI increased 0.5%.

Economists surveyed by Dow Jones had been expecting the measure to increase 7% on an annual basis and 0.4% from November.

The annual move was the fastest increase since June 1982.

Despite the strong gain, stock market futures rose following the news while government bond yields were mostly negative.

“The December CPI report of a 7% increase over the last 12 months will be shocking for some investors as we haven’t seen a number that high in nearly 30 years,” said Brian Price, head of investment management for Commonwealth Financial Network. “However, this print was largely anticipated by many, and we can see that reaction in the bond market as longer-term interest rates are declining so far this morning.”

Excluding food and energy prices, so-called core CPI increased 5.5% year over year and 0.6% from the previous month. That compared to estimates of 5.4% and 0.5%. For core inflation, it was the largest annual growth since February 1991.

Shelter costs, which make up nearly one-third of the total rose 0.4% for the month and 4.1% for the year. That was the fastest pace since February 2007.

Used vehicle prices, which have been a major component of the inflation increase during the pandemic due to supply chain constraints that have limited new vehicle production, rose another 3.5% in December, bringing the increase from a year ago to 37.3%.

Conversely, energy prices mostly declined for the month, falling 0.4% as fuel oil was down 2.4% and gasoline fell 0.5%. Still, the complex as a whole rose 29.3% in the 12-month period, including a gain of 49.6% for gasoline.

Federal Reserve officials are watching the inflation data closely and are widely expected to raise interest rates this year in an effort combat rising prices and as the jobs picture approaches full employment. Though the central bank uses the personal consumption expenditures price index as its primary inflation measure, policymakers take in a wide range of information in making decisions.

“This morning’s CPI read really only solidifies what we already know: Consumer wallets are feeling pricing pressures and in turn the Fed has signaled a more hawkish approach. But the question remains if the Fed will pick up the pace given inflation is seemingly here to stay, at least in the medium-term,” said Mike Loewengart, managing director for investment strategy at E*Trade. “With Covid cases continuing to rise, the impact on the supply chain and labor shortages could persist, which only fuels higher prices.”

Inflation has been eating into otherwise strong wage gains for workers. However, real average hourly earnings posted a small 0.1% increase for the month, as the 0.6% total gain outweighed the 0.5% CPI headline increase. On a year-over-year basis, real earnings declined 2.4%, according to BLS calculations.

Fed officials largely attribute rising inflation pressures to pandemic-specific issues in which a shortage of workers has led to clogged supply chains and empty store shelves. Though there are signs that the omicron variant cases could peak soon, lingering Covid issues combined with cold weather in the Northeast point “to renewed upward pressure on food prices,” wrote Paul Ashworth, chief U.S. economist at Capital Economics.

Food prices broadly rose 0.5% for December and were up 6.3% on a 12-month basis, the biggest rise since October 2008.

Investors largely expect the Fed to start raising rates in March. Fed Chairman Jerome Powell, at his confirmation hearing Tuesday before the Senate banking panel, did not provide any specific dates but acknowledged that as long as current conditions persist, rate hikes are on the way.

Markets are pricing a nearly 79% chance for the first quarter-percentage-point increase to come in May, and see about a 50% chance the Fed could enact four such hikes in 2022, according to the CME’s FedWatch Tool.

While the local grocery stores aren't that bad, there are a ton of empty spaces on the shelves, more than I can ever remember.

That 7% is a lowball average too. Gas and meat are up much higher. I ordered dog food last night and it's gone up 21%.While the local grocery stores aren't that bad, there are a ton of empty spaces on the shelves, more than I can ever remember.

I think you can pretty much bank on this, refinance your big ticket items while you still can. Increased inflation and interest rates will stall the economy.Markets are pricing a nearly 79% chance for the first quarter-percentage-point increase to come in May, and see about a 50% chance the Fed could enact four such hikes in 2022, according to the CME’s FedWatch Tool.

- Joined

- Jun 10, 2014

- Messages

- 11,083

- Reaction score

- 13,239

- Points

- 113

This is unreal. Consider. You wanted to buy a used car pre-vegetable... you could get a decent used car for say, $5k. One that would get you around, last you a few years and run alright.Used vehicle prices, which have been a major component of the inflation increase during the pandemic due to supply chain constraints that have limited new vehicle production, rose another 3.5% in December, bringing the increase from a year ago to 37.3%.

Today, that same car will run you nearly $7k ($6850).

So... you have to bite the bullet to get your used car and eat an extra $2k. THEN you discover that the price of gas has jumped to 1.5X what you would have paid pre-vegetable.Conversely, energy prices mostly declined for the month, falling 0.4% as fuel oil was down 2.4% and gasoline fell 0.5%. Still, the complex as a whole rose 29.3% in the 12-month period, including a gain of 49.6% for gasoline.

So you're obviously pissed and trying to figure out how to make ends meet. You take your crazy expensive used car to the store to get some ******* ramen cause that's all you can afford and discover A) the ramen is gone because the store can't stock it fast enough and B) the next possible alternative is going to cost you twice as much as you expected.

And the state of PA DELETED footage of ballot drop boxes because... "What?"

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

That 7% is a lowball average too. Gas and meat are up much higher. I ordered dog food last night and it's gone up 21%.

The Fed calculates inflation much differently than they did back in 1982 to lie about the numbers. Using even the 1990 methodology, our current inflation is more than 10%.

Alternate Inflation Charts

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

Corrupt scumbag administration ginned up investigation of American citizens, pushed for bullshit letter to give them a reason for the contemptible attack on concerned parents.

Any liberal willing to criticize this? No?

Good to hear. Cannot WAIT for a conservative President to get letters from some group that gives rise to investigation of Twitter, Planned Parenthood, Google, etc.

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

- Joined

- Apr 9, 2014

- Messages

- 23,495

- Reaction score

- 28,226

- Points

- 113

**** you Xiden, you commie piece of ****.

ECONOMY

Inflation rises 7% over the past year, highest since 1982

PUBLISHED WED, JAN 12 20228:31 AM ESTUPDATED 10 MIN AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

WATCH NOW

- The consumer price index, an inflation gauge that measures costs across dozens of items, rose 7% in December from a year ago, the fastest pace since June 1982.

- That was in line, however, with economist estimates, and stock market futures rose after the release.

- Excluding food and energy, so-called core CPI was up 5.5% on the year, the biggest growth since February 1991.

VIDEO04:22

Inflation rises 7% over past year in December, highest in nearly 40 years

Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during December, according to a closely watched gauge the Labor Department released Wednesday.

The consumer price index, a gauge that measures costs across dozens of items, increased 7%, according to the department’s Bureau of Labor Statistics. On a monthly basis, CPI increased 0.5%.

Economists surveyed by Dow Jones had been expecting the measure to increase 7% on an annual basis and 0.4% from November.

The annual move was the fastest increase since June 1982.

Despite the strong gain, stock market futures rose following the news while government bond yields were mostly negative.

“The December CPI report of a 7% increase over the last 12 months will be shocking for some investors as we haven’t seen a number that high in nearly 30 years,” said Brian Price, head of investment management for Commonwealth Financial Network. “However, this print was largely anticipated by many, and we can see that reaction in the bond market as longer-term interest rates are declining so far this morning.”

Excluding food and energy prices, so-called core CPI increased 5.5% year over year and 0.6% from the previous month. That compared to estimates of 5.4% and 0.5%. For core inflation, it was the largest annual growth since February 1991.

Shelter costs, which make up nearly one-third of the total rose 0.4% for the month and 4.1% for the year. That was the fastest pace since February 2007.

Used vehicle prices, which have been a major component of the inflation increase during the pandemic due to supply chain constraints that have limited new vehicle production, rose another 3.5% in December, bringing the increase from a year ago to 37.3%.

Conversely, energy prices mostly declined for the month, falling 0.4% as fuel oil was down 2.4% and gasoline fell 0.5%. Still, the complex as a whole rose 29.3% in the 12-month period, including a gain of 49.6% for gasoline.

Federal Reserve officials are watching the inflation data closely and are widely expected to raise interest rates this year in an effort combat rising prices and as the jobs picture approaches full employment. Though the central bank uses the personal consumption expenditures price index as its primary inflation measure, policymakers take in a wide range of information in making decisions.

“This morning’s CPI read really only solidifies what we already know: Consumer wallets are feeling pricing pressures and in turn the Fed has signaled a more hawkish approach. But the question remains if the Fed will pick up the pace given inflation is seemingly here to stay, at least in the medium-term,” said Mike Loewengart, managing director for investment strategy at E*Trade. “With Covid cases continuing to rise, the impact on the supply chain and labor shortages could persist, which only fuels higher prices.”

Inflation has been eating into otherwise strong wage gains for workers. However, real average hourly earnings posted a small 0.1% increase for the month, as the 0.6% total gain outweighed the 0.5% CPI headline increase. On a year-over-year basis, real earnings declined 2.4%, according to BLS calculations.

Fed officials largely attribute rising inflation pressures to pandemic-specific issues in which a shortage of workers has led to clogged supply chains and empty store shelves. Though there are signs that the omicron variant cases could peak soon, lingering Covid issues combined with cold weather in the Northeast point “to renewed upward pressure on food prices,” wrote Paul Ashworth, chief U.S. economist at Capital Economics.

Food prices broadly rose 0.5% for December and were up 6.3% on a 12-month basis, the biggest rise since October 2008.

Investors largely expect the Fed to start raising rates in March. Fed Chairman Jerome Powell, at his confirmation hearing Tuesday before the Senate banking panel, did not provide any specific dates but acknowledged that as long as current conditions persist, rate hikes are on the way.

Markets are pricing a nearly 79% chance for the first quarter-percentage-point increase to come in May, and see about a 50% chance the Fed could enact four such hikes in 2022, according to the CME’s FedWatch Tool.

This is all part of the build back better while crushing covid program. First things first, we need to crush the economy completely, then build some windmills.

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

This is all part of the build back better while crushing covid program. First things first, we need to crush the economy completely, then build some windmills.

And sailboats. And trains.

(D)imbos longingly think back to 1858, when sailboats, trains, windmills and slavery were ubiquitous.

- Joined

- Apr 9, 2014

- Messages

- 19,992

- Reaction score

- 33,773

- Points

- 113

- Location

- $62.75 would help feed Paxton

Every time I hear that blithering dementia patient whisper, then yell, then blather some incoherent rant ...

Great news. Xiden and Dems are driving kids out of corrupt public schools

nypost.com

nypost.com

Critical race theory, COVID policies in Virginia spark huge jump in homeschooling

Homeschooling in Virginia has increased by nearly 40% since 2019, which has been partly fueled by the implementation of critical race theory in classrooms and the coronavirus. “The chil…