You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bankrupt Illinois

- Thread starter Coach

- Start date

Now they want to hit the people with a 30%+ tax hike.

Yeah, that will help..smh. I was just in Chicago 2 weeks ago. Taxes are already ridiculously high.

Calinois?

I'm going to be in Chicago in the middle of August. The hotel taxation is crazy.

Minimum of $50 for overnight parking too. Valet is usually $60 - $70 / night. Wait until you see what bars charge for a drink, that's when it really gets fun.

- Joined

- Apr 12, 2014

- Messages

- 6,982

- Reaction score

- 6,963

- Points

- 113

Illinois is at the tipping point. It has used up it's current supply of 0PM and now they want to raise taxes again on an already overtaxed populous to try and keep the vote buying party going. If the 30% tax hike goes through look for a ton of businesses to move across the state lines to Indiana and Iowa.

You just can't make this **** up. Odumma's home state and home city where he sent is homeboy to be mayor are utter and complete failures. No wonder he was the worst President this country has ever seen.

Illinois is at the tipping point. It has used up it's current supply of 0PM and now they want to raise taxes again on an already overtaxed populous to try and keep the vote buying party going. If the 30% tax hike goes through look for a ton of businesses to move across the state lines to Indiana and Iowa.

i'm pretty sure that is racist.

- Joined

- Apr 12, 2014

- Messages

- 6,982

- Reaction score

- 6,963

- Points

- 113

i'm pretty sure that is racist.

Yep. Moving to a state where they don't tax the life out of you is racist as ****.

You just can't make this **** up. Odumma's home state and home city where he sent is homeboy to be mayor are utter and complete failures. No wonder he was the worst President this country has ever seen.

Yep, and he doubled our country's debt, adding $10 trillion and nothing to show for it except stronger terrorist organizations and countries.

And there are idiots out there who think that fake global warming is going to wipe out our grandchildren. How about we pay down all of of Obama's debt so they aren't taxed at 60% like those poor ******** in Illinois.

Last edited:

- Joined

- Apr 21, 2014

- Messages

- 11,931

- Reaction score

- 15,740

- Points

- 113

Yep. Moving to a state where they don't tax the life out of you is racist as ****.

Liberals do think that. They think suburbs are racist. You are supposed to stay in a ****** inner city and pay taxes, not move to a nicer area and live a good life. He enacted new rules, that made it mandatory that suburban communities MUST build low income apartments right in the middle of middle class neighborhoods. They tested it outside Dallas and guess what happened. Crime rose in those suburban areas and they became ******. Liberals see that as a success.

Here's a great transcript talking about it

https://www.rushlimbaugh.com/daily/2016/05/09/the_next_step_in_obama_s_war_on_suburbia/

Obama got the ball rolling on so many under the radar things just like this. Changes that could be imposed by unelected bureaucrats at HUD or EPA or any other agency without ever coming up for votes.

Trump winning was one of the most important events in our history. Sure, there are the public things like Obamacare, but there was a lot more unseen that would equally hurt America and Trump is already cancelling many of these programs.

You have to pay your fair share. / BommaHilltwat.

- Joined

- Apr 8, 2014

- Messages

- 9,394

- Reaction score

- 6,217

- Points

- 113

Yep. Moving to a state where they don't tax the life out of you is racist as ****.

and a reason for the courts to get involved if you are moving from Union state to Right to work state.....

- Joined

- Jan 13, 2015

- Messages

- 15,544

- Reaction score

- 3,801

- Points

- 113

Illinois is at the tipping point. It has used up it's current supply of 0PM and now they want to raise taxes again on an already overtaxed populous to try and keep the vote buying party going. If the 30% tax hike goes through look for a ton of businesses to move across the state lines to Indiana and Iowa.

Your 100% correct.

- Joined

- Apr 9, 2014

- Messages

- 18,601

- Reaction score

- 29,977

- Points

- 113

- Location

- The nearest Steelers bar.

Calinois?

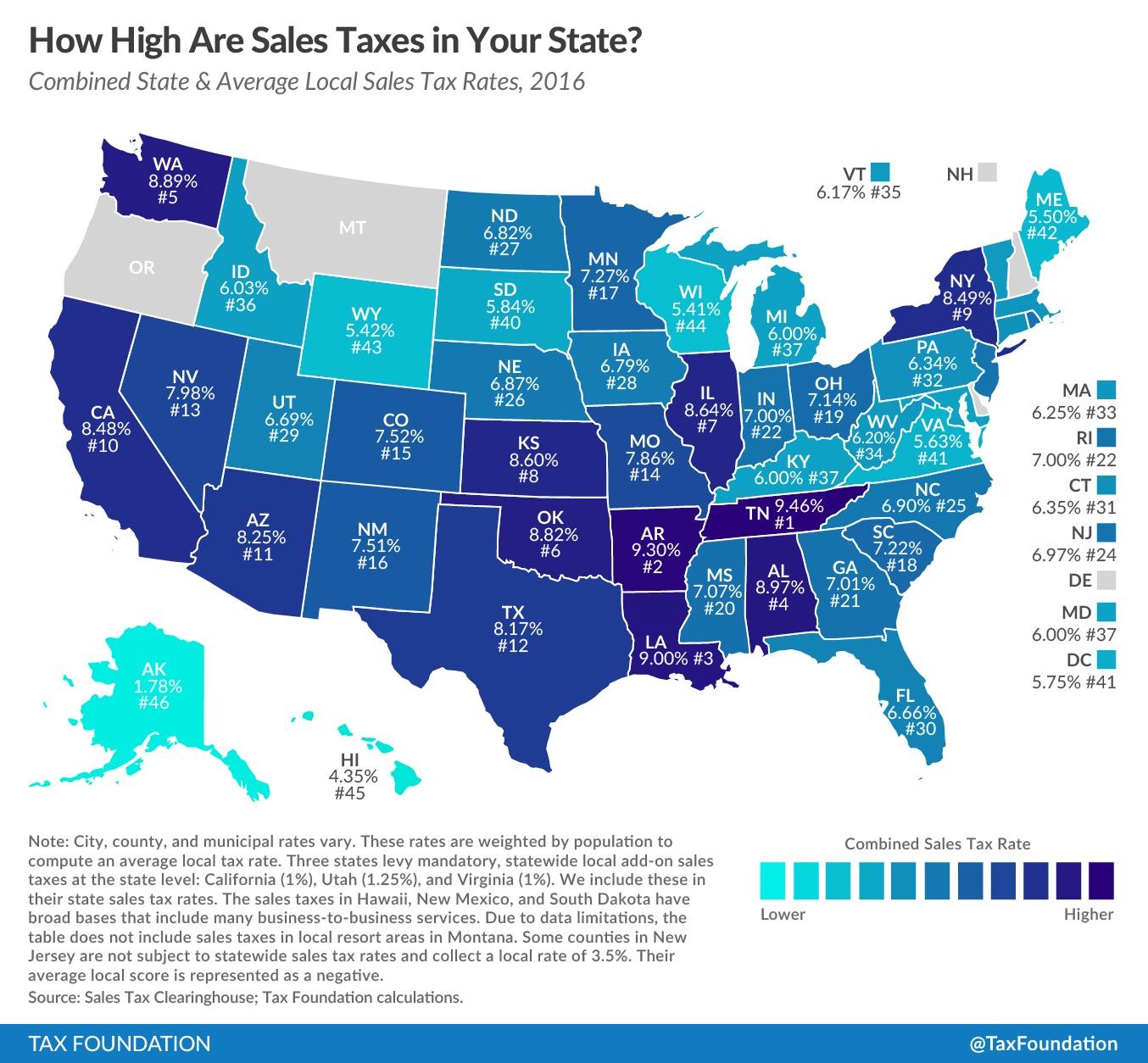

Not close, Supe. Commiefornia stands alone as the highest taxed people - well, those that actually earn a living, that is - in the nation:

Please note that the sales tax needs to be corrected as to LA County - where sales tax is now 10.25%!!

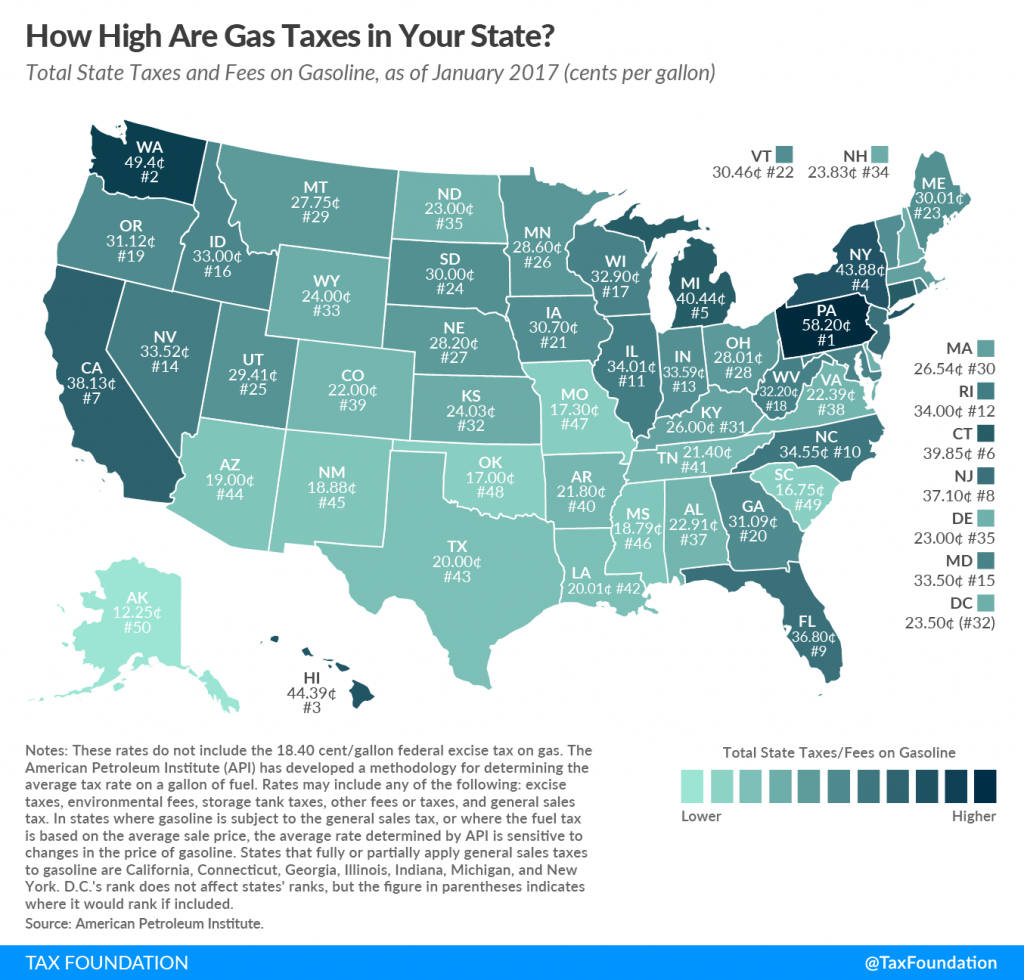

Hey, have no fear - California realized that ranking only 7th in gasoline tax was unacceptable, and very recently voted to increase the gas tax to more than 50 cents per gallon!! Good news, the state will fix the roads. What happened to the multiple billions already collected every year in gasoline taxes?!? Uhhh, I'll have to get back to you on that.

OVERALL TAX BURDEN - CALIFORNIA WINS BIG!!

Wtf pa!

- Joined

- Apr 9, 2014

- Messages

- 18,601

- Reaction score

- 29,977

- Points

- 113

- Location

- The nearest Steelers bar.

Wtf pa!

3% income tax, 6% sales tax, 58 cents per gallon gasoline tax? Pfffft. No competition with California's 13.3% state income tax, 9% sales tax, and NOW 50 cents per gallon gas tax!!

******* California. Massive, massive taxes, billions upon billions pour into the public coffers aaaaand ...

****** roads. Bad schools. But hey, great healthcare for the illegals, awesome welfare benefits for those who can't be bothered with work. It's all good!!

- Joined

- Apr 9, 2014

- Messages

- 20,564

- Reaction score

- 22,395

- Points

- 113

3% income tax, 6% sales tax, 58 cents per gallon gasoline tax? Pfffft. No competition with California's 13.3% state income tax, 9% sales tax, and NOW 50 cents per gallon gas tax!!

******* California. Massive, massive taxes, billions upon billions pour into the public coffers aaaaand ...

****** roads. Bad schools. But hey, great healthcare for the illegals, awesome welfare benefits for those who can't be bothered with work. It's all good!!

And it's filled with leftist commie shitfucks in a good portion of the southern part. They'll learn the hard way when their tax base says **** this and moves out of state. You couldn't pay me enough to move to that country.

And it's filled with leftist commie shitfucks in a good portion of the southern part. They'll learn the hard way when their tax base says **** this and moves out of state. You couldn't pay me enough to move to that country.

That may be true, but I spent a lot of time in SoCal when our plant was there. I really liked it. There was a cool, laid back vibe. The people were chill. My customers out there were great, my suppliers were great, my employees were..not so great but ok. The food was awesome, the weather was awesome except for the damned Santa Ana winds, which made me fear for my life while driving down from the desert. We would still have a plant there if it weren't for the ridiculous taxes and regulations. I've only been to NoCal once and was totally different. That's where the real libtards are. They are high strung and tense. Screw them. I did like the night tour of Alcatraz and the Mondavi-Opus vineyards.

You just can't make this **** up. Odumma's home state and home city where he sent is homeboy to be mayor are utter and complete failures. No wonder he was the worst President this country has ever seen.

You really can't make it up; Illinois like California is one of the states that subsidizes other states. What other states you might ask?

Think banjos and incest, Oh and of course Trump supporters. Don't worry ,Pennsylvania makes the top 20 as far as "leach states" go.

My home state of Oklahoma takes in about 1.97 for every dollar they pay to the treasury. Come visit and all you'll hear is how they love small government and low taxes..........yea you absolutely can not make it up.

The truly twisted "thinking" of CONservatives.

- Joined

- Apr 21, 2014

- Messages

- 5,836

- Reaction score

- 4,780

- Points

- 113

You really can't make it up; Illinois like California is one of the states that subsidizes other states. What other states you might ask?

Think banjos and incest, Oh and of course Trump supporters. Don't worry ,Pennsylvania makes the top 20 as far as "leach states" go.

My home state of Oklahoma takes in about 1.97 for every dollar they pay to the treasury. Come visit and all you'll hear is how they love small government and low taxes..........yea you absolutely can not make it up.

The truly twisted "thinking" of CONservatives.

I so miss your elitist, snobbery when you leave for awhile. I rejoice when you come back. You do fit in perfectly with your party when it comes to looking down on "undesirables" (aka...people that are different from you), I will give you that. You represent the party magnificently.

The Elftardpig is dependent upon taxpayers for income. That thing works for us.

Sent from my iPhone using Steeler Nation mobile app

Sent from my iPhone using Steeler Nation mobile app

http://www.latimes.com/politics/la-pol-sac-california-federal-government-money-20170205-story.html

Column Political Road Map: There's a $368-billion reason why California depends on the federal government

Medicare

John Myers Contact Reporter

During the depths of California’s budget crisis, talk in Sacramento about how many tax dollars were sent to Washington, compared with what the state received in services, generally sparked anger. But these days, it’s triggered fear.

After all, President Trump has promised to rethink the kinds of federal policies whose fiscal importance to the state is writ large. Then there’s the worry that Trump won’t soon forget the thumping he took here on election day, the worst defeat for a GOP presidential candidate in California since 1936.

With those postelection jitters in mind, the state’s independent Legislative Analyst’s Office has pored over the data to calculate a number that is the monetary essence of California’s relationship with the United States.

And what a number it is: The federal government spends some $367.8 billion a year on California. That’s an average of about $9,500 for every woman, man and child in the state.

In truth, the money isn’t spread out evenly. About 56 cents of every federal dollar spent in California, according to the analysis, goes to health or retirement benefits — Social Security, Medicare and money for low-income residents’ health care through the Medi-Cal program.

Defense contracts are the next biggest slice of the pie, followed by paychecks to military and civilian government employees. From there, federal spending gets sprinkled among a number of programs run by the state government. Gov. Jerry Brown’s recent budget plan pegged those funds at a total of $105 billion, equivalent to about 58% of state taxpayer dollars to be spent in the fiscal year that begins on July 1.

That includes subsidizing public universities, a focus of presidential scorn last week. Trump suggested that perhaps federal funds shouldn’t be doled out to UC Berkeley after Wednesday’s violent protests against a planned speech by Breitbart provocateur Milo Yiannopoulos. Total federal spending on California public universities, per the analyst’s report: $4.8 billion a year.

If elected officials feel the need to begin defending existing federal subsidies, it will mark a major departure from a decade’s worth of complaints that California is owed even more money.

Lawmakers have long lamented that Californians pay more in taxes than they receive back in services, hanging their hats on a 2007 report by the conservative Tax Foundation that California is a “donor state” that receives only 78 cents in services for each dollar in taxes paid. But state analysts point out that report added extra tax dollars from Californians — beyond those actually paid — to cover the state’s share of the federal deficit.

Perhaps more accurate is a 2015 state-by-state review compiled by New York officials, one that puts California much closer to breaking even — about 99 cents in federal services for every real dollar in taxes.

The takeaway from the complex calculations is pretty simple: California has a tight fiscal relationship to the nation. There are undoubtedly dollars at risk as the president and congressional leaders rethink programs like the Affordable Care Act. If they revamp retirement or healthcare benefits for older Americans, that would also ripple westward to the Pacific. But the money is spread over dozens of programs, not focused in any single sector. That kind of diversified federal spending would likely act as a circuit breaker to any potential jolt of political punishment from Trump.

Even then, Trump needs California to prosper. Almost 1 in 8 Americans lives here, and the state has created more than 2.4 million jobs since the current economic expansion began seven years ago. He may not like the state’s politics, but Trump the businessman would be wise to see California as a good investment.

Column Political Road Map: There's a $368-billion reason why California depends on the federal government

Medicare

John Myers Contact Reporter

During the depths of California’s budget crisis, talk in Sacramento about how many tax dollars were sent to Washington, compared with what the state received in services, generally sparked anger. But these days, it’s triggered fear.

After all, President Trump has promised to rethink the kinds of federal policies whose fiscal importance to the state is writ large. Then there’s the worry that Trump won’t soon forget the thumping he took here on election day, the worst defeat for a GOP presidential candidate in California since 1936.

With those postelection jitters in mind, the state’s independent Legislative Analyst’s Office has pored over the data to calculate a number that is the monetary essence of California’s relationship with the United States.

And what a number it is: The federal government spends some $367.8 billion a year on California. That’s an average of about $9,500 for every woman, man and child in the state.

In truth, the money isn’t spread out evenly. About 56 cents of every federal dollar spent in California, according to the analysis, goes to health or retirement benefits — Social Security, Medicare and money for low-income residents’ health care through the Medi-Cal program.

Defense contracts are the next biggest slice of the pie, followed by paychecks to military and civilian government employees. From there, federal spending gets sprinkled among a number of programs run by the state government. Gov. Jerry Brown’s recent budget plan pegged those funds at a total of $105 billion, equivalent to about 58% of state taxpayer dollars to be spent in the fiscal year that begins on July 1.

That includes subsidizing public universities, a focus of presidential scorn last week. Trump suggested that perhaps federal funds shouldn’t be doled out to UC Berkeley after Wednesday’s violent protests against a planned speech by Breitbart provocateur Milo Yiannopoulos. Total federal spending on California public universities, per the analyst’s report: $4.8 billion a year.

If elected officials feel the need to begin defending existing federal subsidies, it will mark a major departure from a decade’s worth of complaints that California is owed even more money.

Lawmakers have long lamented that Californians pay more in taxes than they receive back in services, hanging their hats on a 2007 report by the conservative Tax Foundation that California is a “donor state” that receives only 78 cents in services for each dollar in taxes paid. But state analysts point out that report added extra tax dollars from Californians — beyond those actually paid — to cover the state’s share of the federal deficit.

Perhaps more accurate is a 2015 state-by-state review compiled by New York officials, one that puts California much closer to breaking even — about 99 cents in federal services for every real dollar in taxes.

The takeaway from the complex calculations is pretty simple: California has a tight fiscal relationship to the nation. There are undoubtedly dollars at risk as the president and congressional leaders rethink programs like the Affordable Care Act. If they revamp retirement or healthcare benefits for older Americans, that would also ripple westward to the Pacific. But the money is spread over dozens of programs, not focused in any single sector. That kind of diversified federal spending would likely act as a circuit breaker to any potential jolt of political punishment from Trump.

Even then, Trump needs California to prosper. Almost 1 in 8 Americans lives here, and the state has created more than 2.4 million jobs since the current economic expansion began seven years ago. He may not like the state’s politics, but Trump the businessman would be wise to see California as a good investment.

Similar threads

- Replies

- 16

- Views

- 233

- Replies

- 8

- Views

- 530

- Replies

- 159

- Views

- 2K

- Replies

- 206

- Views

- 2K